First Flight Insurance Group is an insurance brokerage firm offering specialty insurance programs throughout the United States. For a new line of business, First Flight began administering payments and partner payouts for a 3rd-party Contractual Liability Insurance Policy (CLIP).

The challenge

When the partnership’s projected transactions climbed to the hundreds of thousands per month, it became clear that tracking payments and calculating payouts manually in a spreadsheet was not going to be sustainable. First Flight needed a way to automate the entire process.

As part of this 5-way partnership, First Flight wanted to create a self-service payment portal integrated with the product being sold: a B2B SaaS application. This portal also needed to track sales channel referrals, collect recurring payments, and calculate regular payouts to all partners.

With only two months left before the new portal needed to go live, First Flight reached out to Vaporware for help.

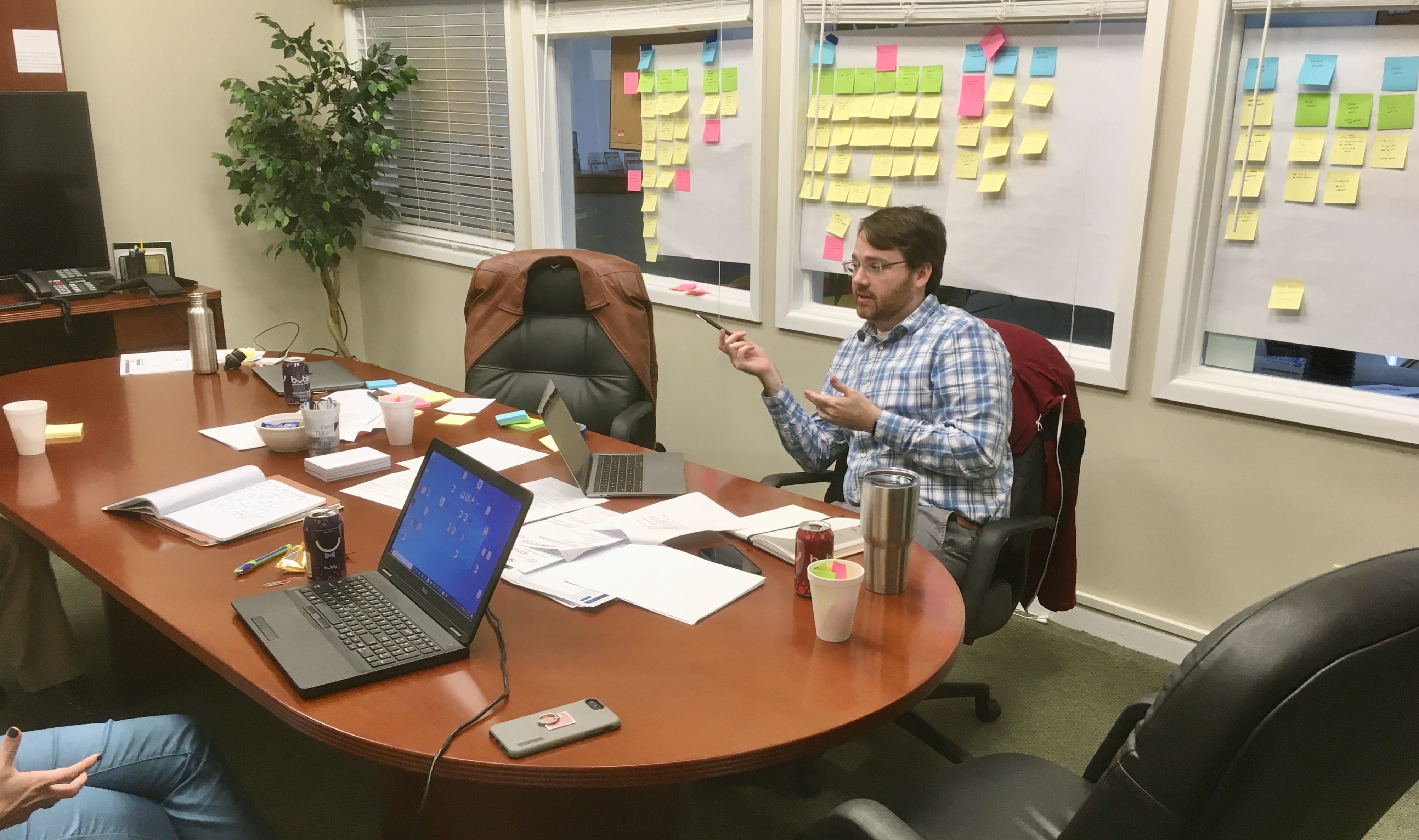

Orienting the team and aligning efforts

As with many of our engagements, we began with our Plan service, a 3-day planning sprint where we met with key stakeholders to understand the problem, generate ideas, and converge on a proposed solution.

By the end of the week, we had compiled a product blueprint detailing the product vision, hypothesis, prioritized goals, success metrics, critical path, and conceptual designs for delivering the right product.

The week after our proposal was approved and with only six weeks until launch, we began to design and develop.

Unifying systems

The first challenge we tackled was integrating First Flight’s core system with its SaaS partner and Stripe.

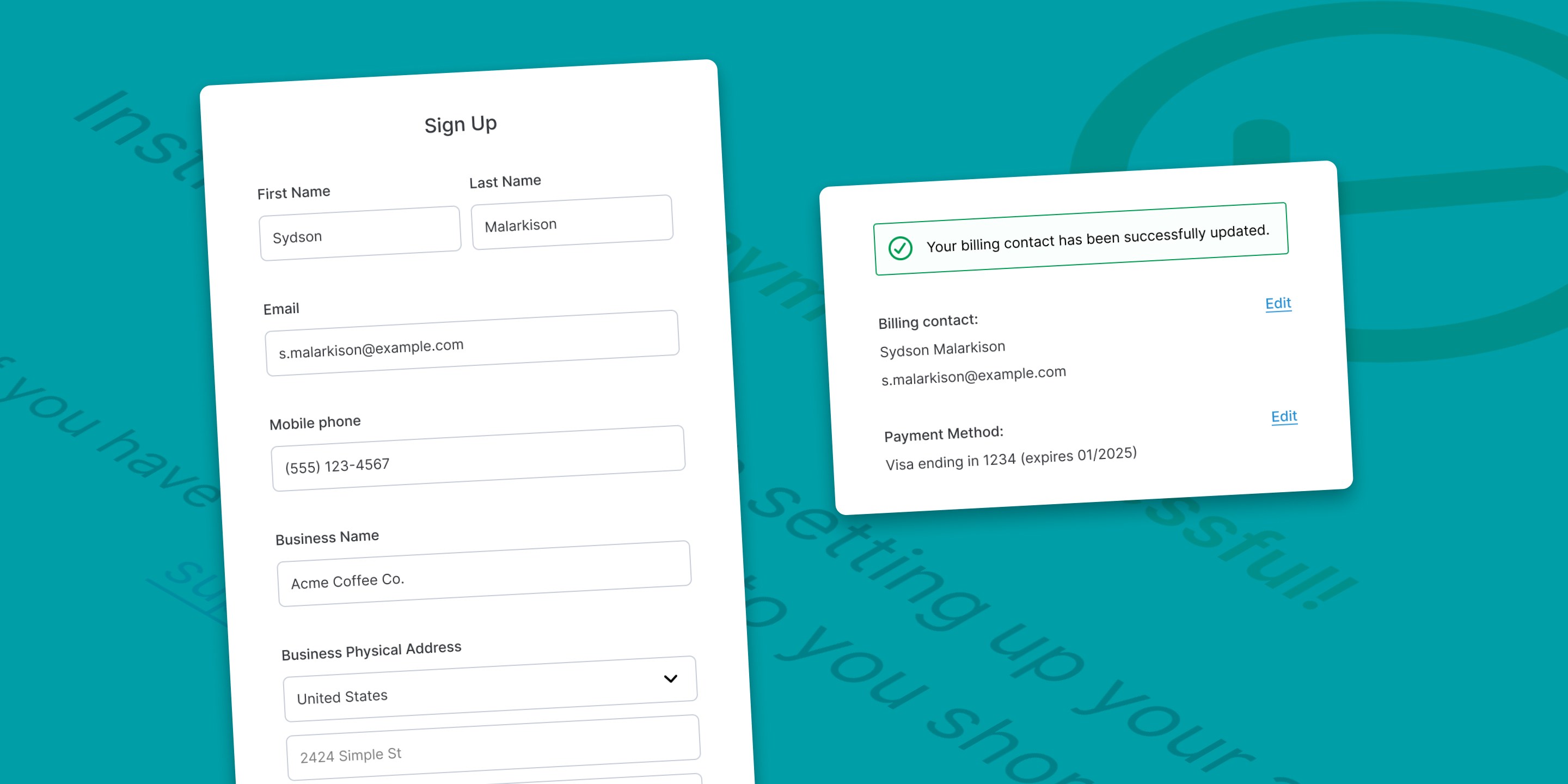

Seamless customer experience

While there were 5 different partners involved, we strived to create a seamless customer experience. Throughout development, we met regularly with partners to synchronize our efforts to achieve this.

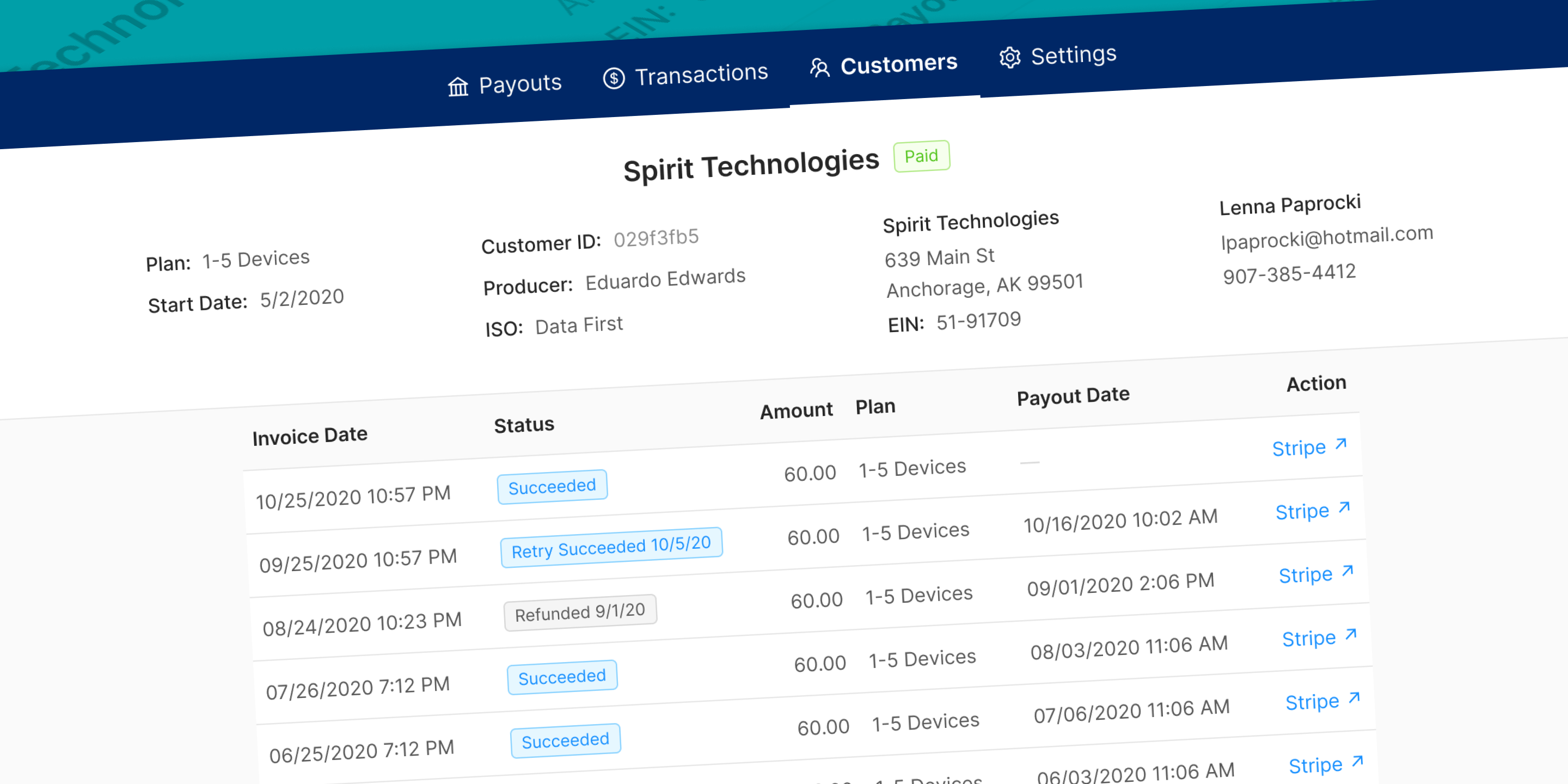

We created a customer signup process that tracked which sales organization the customer came through so that the correct sales partner would receive the correct payout split. After collecting the initial service payment, the customer was automatically enrolled in the SaaS partner’s product.

When a customer needed to update their billing information, which lived in First Flight’s system, all they had to do was click a button in their product interface. Behind the scenes, we created a secure and seamless single sign-on system so that the user didn’t have to sign into a separate system to securely update their billing information.

To ensure customers weren’t confused by the partnerships or transactions, all customer pages, bank statements, and receipts only utilized the SaaS partner’s branding—a true white-labeled experience.

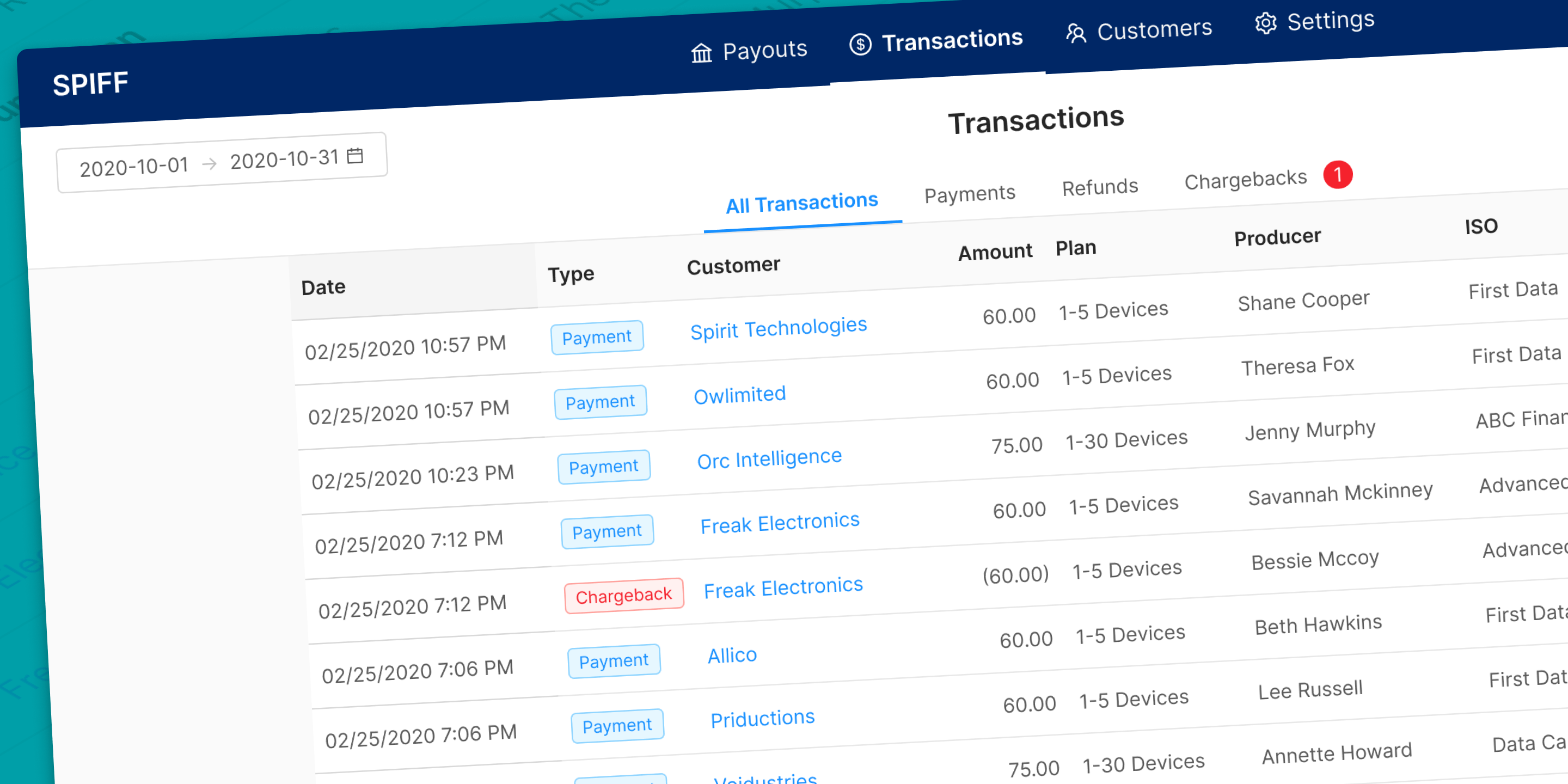

Collecting recurring payments with Stripe

Stripe is a very robust payment platform that has handled billions of transactions. Along with that power and flexibility comes a lot of complexity and unnecessary functionality, so we focused on simplifying the experience for First Flight by providing all the transaction data they needed within their own portal.

We also automated changes to customer subscriptions whenever they were made on the SaaS partner’s side.

Automating flows

Once we had integrated all the required systems, we turned towards streamlining First Flight’s managerial workflows.

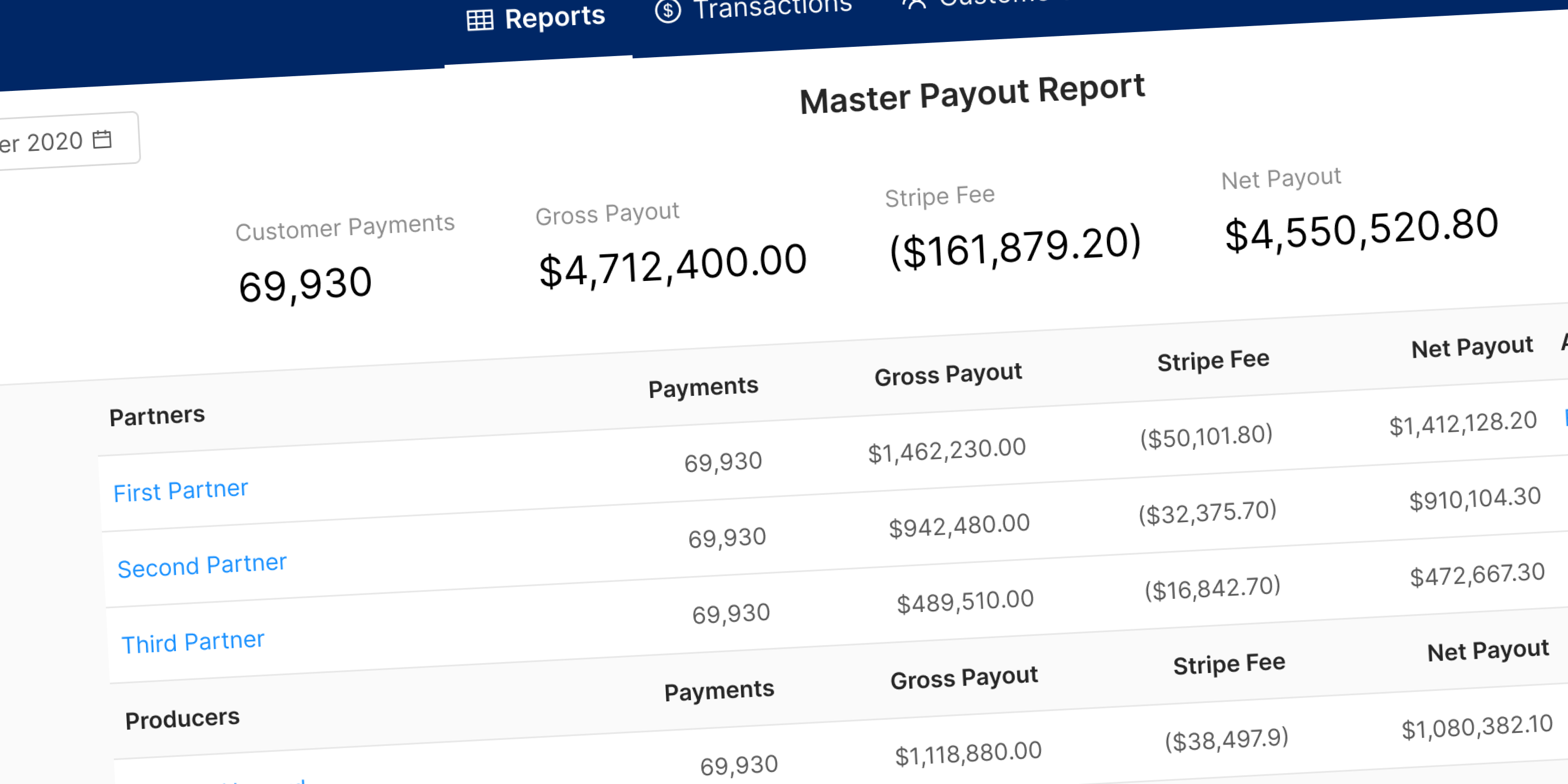

Calculating partner payout splits

With an estimated hundreds of thousands of transactions, we needed to find a way to simplify the task of calculating payouts to each of the parties. During this initial engagement, we didn’t have the time or budget to automate the actual outgoing payments, so we focused on making it as easy for First Flight to write those checks.

When sending a payout to another party, First Flight needed to include a report of all the transactions relevant to that party. To handle this, we created a simple action that generated and downloaded separate reports for each partner, allowing First Flight to calculate the payout amount for each one and back it up with all the transactional data.

While we initially operated on the assumption that these payouts would be happening on a monthly basis, the business later determined these should be able to happen on arbitrary schedules. Thanks to our agile practices, we were able to adjust the design of the system accordingly while staying within budget and timeline.

Alerting the right people when things go wrong

Automation is much easier when everything goes according to plan. In finance, that’s rarely the case. We created workflows for many of these edge cases, including how to handle non-payments, chargebacks, unresponsive servers, and downtime.

To handle these scenarios, we incorporated manual actions First Flight could take to issue refunds, handle chargebacks, and cancel customer subscriptions.

Since financial transactions are insurance liability is vital, we also created a robust auditing system to track all API requests between the various systems. If one of the systems is unresponsive, an alert is generated to ensure all payments, payouts, and customer actions are handled appropriately.

Delivered. On time.

It was a tight deadline, but we made it by keeping priorities focused and proactively working with the partners when issues arose.

The new platform we created has enabled First Flight to diversify their offering to mass payment management through the seamless integration of several systems. Furthermore, it:

- Requires no human interaction to manage millions of customer billing accounts

- Provides a single source of truth for transactions and payout splits

- Tracks sales channels and generates individualized reports for their business partners

- Allows for flexible payout schedules and includes system variables to scale and adjust business models

- Simplified the processes unique to their business process, without the potential for operator error

- Provides peace of mind with robust audit logs of automated actions

- Is seamlessly integrated within a SaaS customer experience

Core App Platform & API

Ruby on RailsFrontend Javascript

React JSSubscriptions

Stripe